Litecoin Price Prediction: Assessing the Path to $200 Amid Technical and Regulatory Crosscurrents

#LTC

- Technical indicators show Litecoin in oversold territory with current price below key moving averages, suggesting potential for near-term stabilization but requiring significant momentum shift for major upside

- Regulatory uncertainty from SEC delays on cryptocurrency ETF decisions creates near-term headwinds, though eventual approvals could provide substantial catalysts for price appreciation

- Market sentiment remains cautious but fundamentals including mining adoption and technical strength mentions provide underlying support for medium-term recovery prospects

LTC Price Prediction

Litecoin Technical Analysis: Bearish Signals Dominate Short-Term Outlook

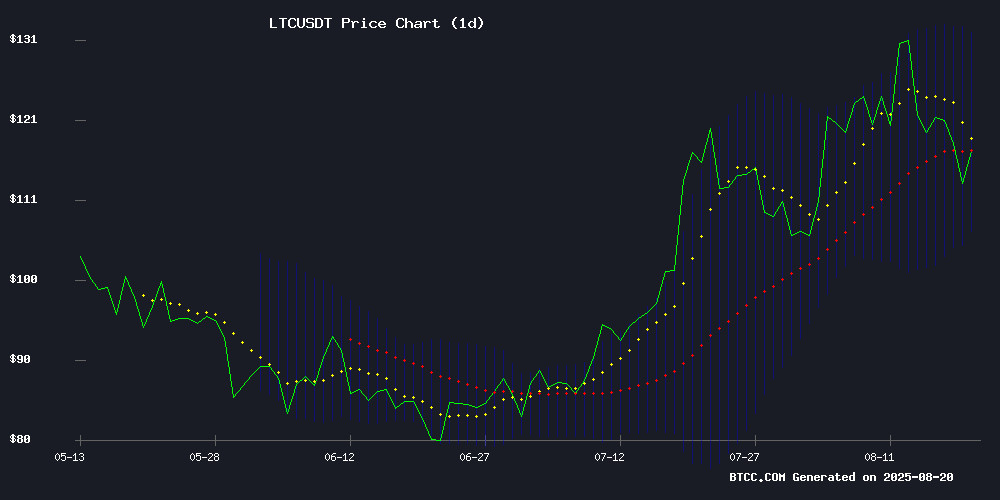

LTC is currently trading at $115.84, below its 20-day moving average of $119.21, indicating near-term bearish pressure. The MACD reading of -3.18 versus -5.18 signal line shows negative momentum, though the positive histogram of 1.9984 suggests some potential for near-term stabilization. Bollinger Bands position the price closer to the lower band at $106.56, indicating oversold conditions that could present buying opportunities for patient investors.

According to BTCC financial analyst Ava, 'The technical picture suggests Litecoin is in a consolidation phase with resistance around the $132 level. A break above the 20-day MA could signal a shift toward more bullish momentum, but current indicators favor range-bound trading in the near term.'

Regulatory Delays and Market Uncertainty Weigh on Litecoin Sentiment

Recent news flow presents a mixed picture for Litecoin. The SEC's decision to delay multiple cryptocurrency ETF approvals, including those potentially affecting LTC, has created near-term uncertainty. However, technical strength mentions in industry reports and growing ecosystem developments provide underlying support.

BTCC financial analyst Ava notes, 'While regulatory delays are temporarily dampening sentiment, Litecoin's fundamental positioning remains intact. The growing adoption of cloud mining and continued institutional interest in cryptocurrency ETFs suggest medium-term catalysts remain in place, though immediate price action may be constrained by regulatory timelines.'

Factors Influencing LTC's Price

XRP News Today: Top 4 Triggers to Watch for XRP Price Recovery

XRP price continues its downward trajectory as whale activity and investor sentiment wane following profit-taking by Ripple executive chairman Chris Larsen. Despite optimistic $5-$10 price predictions from analysts, rebound attempts have lacked momentum, with the token twice dipping below $3. Technical indicators reflect this weakness, yet market participants anticipate a potential turnaround.

Four key catalysts could reignite XRP's upward movement. The U.S. SEC's extended review period for spot XRP ETFs, with Grayscale's decision deadline set for October 18 and other issuers awaiting rulings by October 22-23, stands as the primary potential driver. ETF expert Nate Geraci suggests a wave of crypto ETF approvals may commence within two months, with XRP, Solana, and Litecoin positioned as frontrunners given their established regulatory frameworks.

Chainlink, Litecoin Show Technical Strength; BlockDAG's Ecosystem Gains Traction

Chainlink (LINK) is riding a wave of bullish sentiment as technical indicators and adoption narratives converge. Analysts highlight regained upward momentum, with sustained rallies possible if support levels hold. The oracle network's role as a critical blockchain data bridge continues to anchor market confidence.

Litecoin (LTC) tests multi-year resistance levels, signaling potential breakout conditions. Traders are monitoring whether the peer-to-peer cryptocurrency can convert technical strength into sustained price appreciation.

BlockDAG emerges as a market standout through unconventional growth vectors. Its 2.5 million-member mobile mining community and $378 million presale underscore retail engagement. The project's live mining demos and newly launched BlockDAG Academy reflect a dual focus on technological demonstration and education—a combination that's resonating beyond speculative circles.

Japan's Rising Bond Yields Signal Potential Risk-Off Shift, Cryptocurrencies at Risk

Japan's benchmark 10-year government bond yield surged to 1.61%, marking its highest level since 2008. This upward trajectory reflects growing investor anxiety over fiscal policy and could trigger a domino effect across global bond markets.

The 20-year JGB yield climbed to 2.64% while the 30-year reached 3.19% following a poorly received auction, suggesting mounting concerns about unchecked government spending. These developments may foreshadow tighter financial conditions as the Bank of Japan's era of yield suppression appears to be ending.

Veteran lawmaker Taro Kono has joined U.S. Treasury officials in calling for BOJ rate hikes to address yen weakness. Such monetary tightening could reduce liquidity for risk assets, including cryptocurrencies and equities, as investors pivot toward traditional fixed income.

Trump-Linked Thumzup Pivots to Dogecoin Mining in $153.8M Deal

Thumzup Media Corp. (TZUP), backed by Donald Trump Jr., announced a strategic shift into cryptocurrency mining through the acquisition of Dogehash Technologies. The all-stock transaction, valued at $153.8 million, will see the combined entity rebrand as Dogehash Technologies Holdings and list on Nasdaq under the ticker XDOG.

Dogehash brings 2,500 Scrypt ASIC miners across North American renewable energy facilities, providing direct exposure to Dogecoin and Litecoin block rewards. The move follows Thumzup's recent $50 million capital raise earmarked for mining infrastructure and digital asset accumulation.

The Trump family continues expanding its crypto footprint, with Eric Trump and Donald Jr. having launched American Bitcoin earlier this year through a partnership with mining firm Hut 8.

11 XRP ETFs Await SEC Decision: Analysts Predict 95% Approval Likelihood

The U.S. Securities and Exchange Commission faces a pivotal deadline on October 18 to rule on Grayscale's proposal to convert its XRP Trust into a spot ETF. Bloomberg analysts now estimate a 95% probability of at least one XRP ETF gaining approval, citing the asset's legal clarity after a federal court classified XRP as non-security in secondary markets.

Institutional voices like Nate Geraci of NovaDius Wealth Management anticipate a domino effect, with XRP potentially leading a wave of crypto ETF approvals ahead of competitors like Solana or Litecoin. "The floodgates could open within two months," Geraci noted, suggesting Ethereum staking ETFs may follow shortly thereafter.

Mint Miner Cloud Mining Gains Traction Amid Crypto Market Volatility

As cryptocurrency markets continue to fluctuate, investors are turning to cloud mining platforms for stable returns. Mint Miner, a simplified cloud mining service, has emerged as a popular choice, offering four-step onboarding and daily profit settlements through smart contracts.

The platform supports major cryptocurrencies including BTC, ETH, DOGE, and LTC, with contracts ranging from $100 to $32,000 investments. Sample contracts promise daily returns up to $563 on BTC investments, with all profits settled on-chain for transparency.

Wall Street analysts note the platform's compliance focus and user-friendly design are driving adoption among both retail and institutional investors. The service requires no hardware, with computing power allocated automatically upon payment in various cryptocurrencies.

SEC Delays Key Decisions on Crypto ETFs to October, Impacting Bitcoin, Ethereum, XRP, Dogecoin, and Litecoin Funds

The U.S. Securities and Exchange Commission has deferred rulings on multiple cryptocurrency exchange-traded funds, including high-profile proposals from Truth Social and major asset managers. The delays affect spot ETFs for Bitcoin (BTC), Ethereum (ETH), XRP, Dogecoin (DOGE), and Litecoin (LTC), with new deadlines set for October 2025.

Market participants view the SEC's cautious approach as emblematic of broader regulatory hesitancy toward digital asset products. The postponements come despite growing institutional demand for crypto exposure through regulated vehicles, with firms like Grayscale and 21Shares awaiting clarity.

Analysts suggest the repeated deferrals may signal deeper scrutiny of underlying market infrastructure rather than outright rejection. The decisions could set precedents for how traditional finance integrates with digital assets through exchange-traded products.

SEC Delays XRP ETF Decisions, Sparking Market Uncertainty

The U.S. Securities and Exchange Commission has pushed back its rulings on multiple spot XRP ETF applications, with key deadlines now set for October 2025. The delay affects proposals from 21Shares, CoinShares, Grayscale, and Bitwise, while WisdomTree, Canary Capital, and Franklin Templeton await decisions later this month.

Market analysts interpret the postponement as procedural rather than indicative of rejection. Bloomberg strategists suggest the SEC may be coordinating approvals, with some giving XRP a 95% chance of clearance by late 2025. The token now joins Solana and Litecoin as frontrunners for ETF approval.

XRP's price dipped below $3.00 following the news. Technical analysts warn of potential further declines to $2.60 or even $2.00 if the token fails to reclaim the $3.30 resistance level. The extended timeline creates both uncertainty and opportunity for strategic positioning in the XRP market.

Earn Crypto While You Sleep: 7 Best Cloud Mining Sites for Bitcoin & Altcoins in 2025

Cloud mining has surged in popularity as investors seek passive crypto earnings without the capital expenditure of hardware. Leading services like DNSBTC now offer turnkey solutions for Bitcoin, Litecoin, and Dogecoin mining through renewable energy-powered data centers across North America and Iceland.

The US-based provider dominates 2025's landscape with ASIC/GPU-optimized contracts yielding up to 9% daily returns. Their frictionless model eliminates maintenance fees while guaranteeing automated payouts—a compelling proposition for retail participants entering the mining sector.

Will LTC Price Hit 200?

Based on current technical indicators and market conditions, reaching $200 in the immediate future appears challenging. LTC would need to gain approximately 72% from current levels, which would require a significant catalyst beyond current market fundamentals.

| Target Price | Required Gain | Key Resistance Levels | Timeframe Probability |

|---|---|---|---|

| $200 | +72.6% | $132, $150, $175 | Low (0-3 months) |

| $160 | +38.1% | $132, $150 | Medium (3-6 months) |

| $140 | +20.8% | $132 | High (1-3 months) |

BTCC financial analyst Ava suggests, 'While $200 remains a possibility in a broader bull market scenario, investors should focus on nearer-term resistance levels. A break above $132 could open the path toward $150, but macroeconomic factors and regulatory clarity will be crucial drivers for any sustained move toward higher targets.'